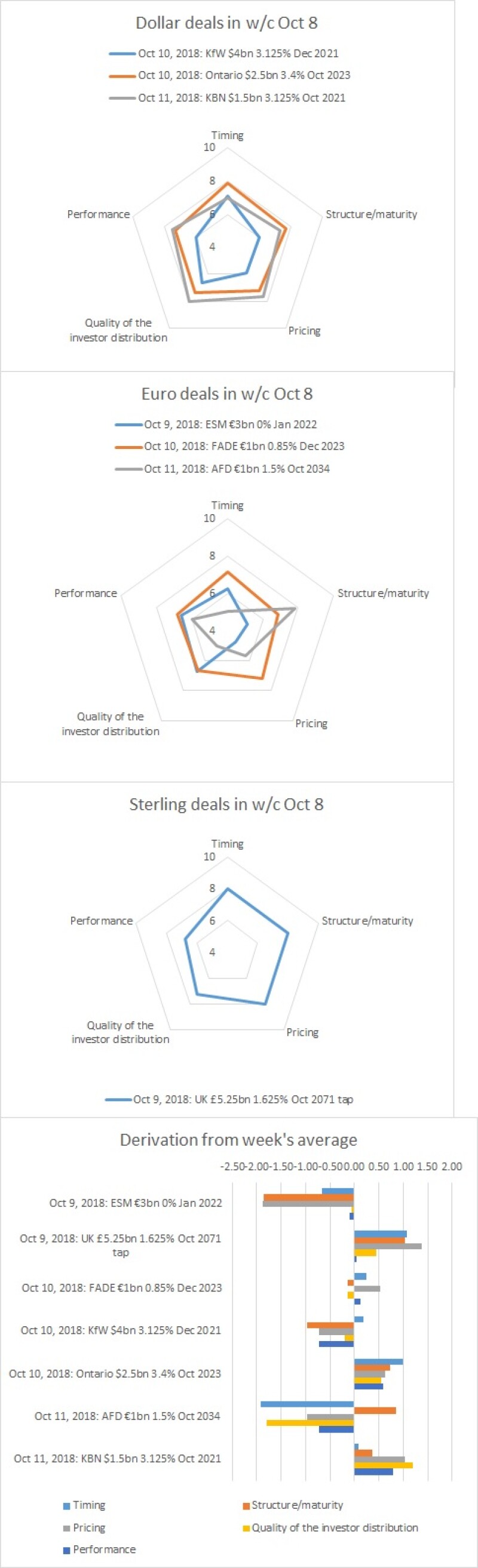

The UK’s £5.25bn October 2071 tap was the highest scorer among the deals in the week commencing October 8, but only mustered an overall average of 7.60 — a far cry from the 8.64-9.47 range it had scored in so far this year.

The deal generally scored highly, but was let down by a 6.75 for performance.

At the other end of the scale, the European Stability Mechanism’s €3bn January 2022 and Agence Française de Développement’s €1bn October 2034 came joint bottom with overall averages of 5.90.

Both deals scored poorly for pricing — ESM on 4.75 and AFD on 5.67 — but in other areas were let down in different categories. ESM mustered just 5.13 for structure/maturity — in keeping with comments at the time of pricing that the tenor was too defensive — while AFD’s barely subscribed deal took 5.00 for quality of investor distribution.

ESM’s $3bn two year from last week, as well as EIB’s $3bn five year and JBIC’s dual tranche dollar deal, are available to score on BondMarker.