Covered Bonds

-

◆ US gives further clues on MDB support ◆ FIG issuers face funding choices ◆ What's the point of the EU green bond standard?

-

The potential for further Trump-induced volatility leaves issuers saving covered bonds for even rainier days

-

Hungarian bank is set to embark on a non-deal roadshow later this month

-

◆ Issuer happy to print more at tight price ◆ Single digit premium paid ◆ Australian covered spreads hold firm

-

The awards recognise the market's leading deals, issuers, banks and other participants

-

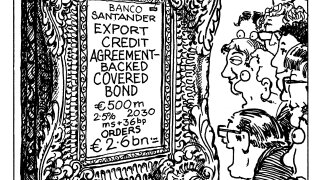

◆ Bond secured against a pool of export credit agreements ◆ Santander gets biggest bid-to-cover ratio since March ◆ Deal lands flat, if not through, fair value

-

The processes of choosing a new Pope and someone to run Crédit Agricole’s CIB may have more in common than you think

-

◆ Small books do not mean small deals ◆ Norwegian trade lands tight to Pfandbriefe ◆ Next to no premium paid

-

◆ Deal is the first Austrian benchmark since January ◆ Slim premium paid ◆ Austrian supply down due to lower loan growth

-

◆ SLBs miss targets with hundreds more up for review ◆ US issuers make hay in European sunshine ◆ Banks probe longer dated debt issuance

-

Favourable factors support long dated issuance in both senior and covered bonds despite the divergent fates of issuers in the two markets

-

◆ Less frequent and smaller Europeans return after Iccrea reopening ◆ Latest sub-benchmark Austrian deal adds issuer diversity ◆ CCF meets annual funding need