UBS

-

Sovereign gets second largest book ever despite political hubbub

-

Swiss pharma company navigates a difficult market to pay a negative to zero new issue premium

-

Investors pounce on Société Générale and UBS sales after yields rise, then rates rally to soothe fears

-

◆ SocGen and especially UBS garner huge demand for high yielding AT1s ◆ Red-hot interest suggests more European banks could issue in subordinated Yankees ◆ HSBC and BBVA raise $2.75bn in tier two

-

A swift combination of the UK investment banking teams of UBS and Credit Suisse shows the rapid progress that has been made, as CEO Sergio Ermotti looks ahead to a ‘pivotal 2024’

-

Kiwi sub-sovereign sacrifices size to price tight

-

Flavour and fragrance company capitalises on investor demand to take size at a tight price

-

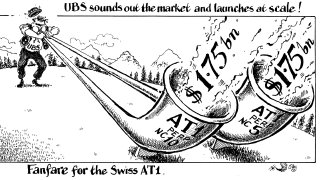

◆ Deal marketed at a price to sell ◆ Structure suggests UBS is optimising funding volume ◆ Reluctance to buy Swiss AT1s remains but fixed income markets are recovering

-

Higher rates are powering an equilibrium in the AT1 market that may tempt even the most unlikely of issuers to come to the market

-

Name recognition helps bank go against the grain to tighten pricing

-

Former IB co-CEO to join as vice-chair of corporate and investment bank

-

Strong name recognition helps Swiss pharma company achieve size at a tight price