The Netherlands

-

Less frequent issuers face tricky bond execution as De Volksbank fails to move past initial pricing

-

The plant-based polymer company 'regained footing' after falling out with BASF

-

Unsatisfied with overnight blocks, Avantium experiments with a three-part offering

-

A long drought of new convertible issuance is over in Europe

-

Dutch insurer looks to buy back Dutch guilder subordinated paper

-

Other Dutch covered bond issuers likely to follow suit

-

Strong support for national champions as market volatility persists

-

Tech-focused investment bank GP Bullhound successfully launched its first blank cheque company this week, despite a market backdrop that could not be much worse for the asset class

-

Company blames market conditions for the cancellation of €252m initial public offering

-

Expanding M&A firm opens office in Netherlands

-

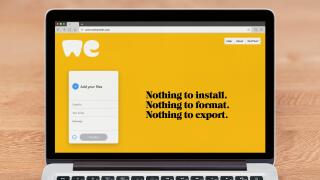

The file transfer service will start trading in Amsterdam on January 28

-

Vincent Goedegebuure to fill position left vacant by Harm Bots last year