Top Section/Ad

Top Section/Ad

Most recent

'Hard to classify' Italian corporate trade being marketed to FIG and SSA accounts

BMW heiress Susanne Klatten exits turbine maker

Development bank's credit ratings suffered a blow after Russia's invasion of Ukraine

Another defaulter, Argentina, likely to tap market this year

More articles/Ad

More articles/Ad

More articles

-

States will need to work out how to service the debt

-

Talk of a new EU funding programme set a volatile backdrop

-

EU spreads widen as supranational and agency investors hedged against Bunds face steepening losses

-

Issuers hobbled in euros, big deals advance in dollars

-

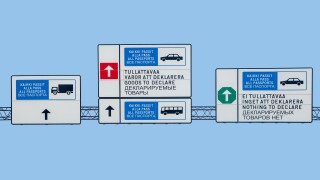

As foreign banks help expat employees to leave the country, Russian desks 'are still operating'

-

Analysts say Europe could cope as spring is coming