Top Section/Ad

Top Section/Ad

Most recent

Second Canadian lender to declare official support for embryonic SSA issuer as government takes lead on establishing new entity

Project to establish bond-issuing multilateral bank gets under way, aiming to strengthen Nato and allies’ defence capacity and procurement

Data center ABS may have captured vast attention but the infrastructure data centers require — in particular fiber optic cable networks — will also be a rich source of securitization activity

IPO pace has been quickened but CSG structure was exceptional

More articles/Ad

More articles/Ad

More articles

-

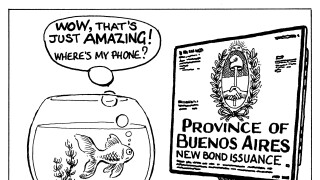

Shunted bondholders feel the Province of Buenos Aires’ coercive negotiation tactics will hurt its reputation in credit markets, but investors rarely have such long memories

-

Handelsbanken has hired a former NIB CFO to run its sustainable finance team

-

The two southeast Asian firms receive strong response from the market during syndication

-

The fervour for ESG assets is spurring a renewed push by private credit to lend to small businesses

-

They are the latest departures from the Swiss bank in the wake of the Archegos and Greensill debacles

-

Central banks’ control was once limited to financial matters — they squatted in the corner, largely unseen. Now, they are stars in the drama — active, talkative stewards of the economy. Society looks to them to solve its problems; not to synch with government, but to make up for its deficiencies.