Top Section/Ad

Top Section/Ad

Most recent

2025's best deals, banks, investors, advisers and law firms

GlobalCapital is pleased to announce the launch of its 2026 European Securitization Awards

GlobalCapital's inaugural MTN Awards 2026 are underway — the market’s only awards dedicated to the market. But time is running out to make your case

Voting now open to decide the market’s leading deals and institutions

More articles/Ad

More articles/Ad

More articles

-

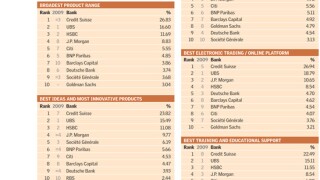

The Swiss bank usurped its rival UBS to take the top sport for equity-linked structured products in our latest poll. A lot of credit for this must go to recent hires Min Park and Kenneth Pang, who Credit Suisse recruited from its competitor.

-

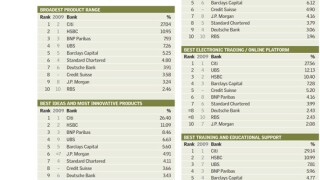

The UK-headquartered bank ranked first in this category for the first time in ASIAMONEY's Structured Products Poll. It says that its success is mostly a result of concentrating on broad structured credit advice to its clients.

-

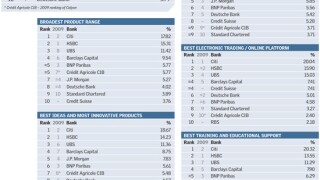

The Swiss bank takes top honours for all three main categories of Asiamoney’s largest Private Banking Poll. Deutsche, BNP Paribas, Maybank and Citi also did well.

-

Citi, HSBC and Credit Suisse were the big winners in our annual Structured Products Poll. But with the US government keen to enact tough regulatory reform of the derivatives market, the entire structured products universe could be a very different place in the coming year. Richard Morrow reports.

-

The US bank stood above its rivals for both local and G3 currency structured products for a 12 month period of marked volatility.

-

The US bank has beaten out its arch-rival HSBC to come first in both local currency and G3 interest rate products, a testament to the depth of its relationships with corporate and retail investors.