Top Section/Ad

Top Section/Ad

Most recent

2025's best deals, banks, investors, advisers and law firms

GlobalCapital is pleased to announce the launch of its 2026 European Securitization Awards

GlobalCapital's inaugural MTN Awards 2026 are underway — the market’s only awards dedicated to the market. But time is running out to make your case

Voting now open to decide the market’s leading deals and institutions

More articles/Ad

More articles/Ad

More articles

-

Nomura’s Asia Pacific House of the Year win shows that when doing business in the region, it pays to have a local pedigree, knowledge and a commitment to Asia.

-

Depth in research and execution and strength in structuring globally in vanilla and exotic products across all asset classes set UBS apart from its competitors in the retail and institutional structured product market over the last year. That, and its development of electronic trading platforms, helped the firm land the 2012 Structured Products House of the Year award from the editors of Derivatives Week/Derivatives Intelligence.

-

To say the markets over the last 12 months have endured periods of heightened volatility would be an understatement. Buysiders, as a result, sharpened their awareness and upped capital allocation to volatility products, whether through exchange-traded notes, exchange-traded funds, or bespoke indices linked to the VIX. Those buyers, including asset managers and pension funds, tagged Nomura as ahead of the competition for its innovation in volatility themed strategies, indices, funds and products. That helped the firm land the 2012 Volatility House of the Year award from the editors of Derivatives Week/Derivatives Intelligence.

-

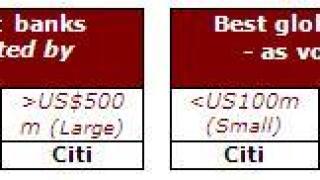

The US bank is deemed most popular by financial institution clients, while Deutsche Bank tops the small and medium categories as voted by corporates

-

HSBC has been at the forefront of both developed and emerging fx market over the last year, particularly through driving the development and growth of the offshore renminbi market. It was behind the first CNH spot transaction and the first CNH option as well as getting more esoteric with the first structured note linked to CNH. These were the key factors in the firm landing the 2012 FX Derivatives House Of The Year award from the editors of Derivatives Week/Derivatives Intelligence.

-

The overall result for ASIAMONEY's 2012 Private Banking Poll.