Top Section/Ad

Top Section/Ad

Most recent

Project to establish bond-issuing multilateral bank gets under way, aiming to strengthen Nato and allies’ defence capacity and procurement

LatAm agency brings second digital bond this year in the currency

Viswas Raghavan’s move to Citi from JP Morgan 18 months ago has shaken up both institutions and provoked an intense Wall Street rivalry

New firm mine. aims to build 'institutional memory' for borrowers

More articles/Ad

More articles/Ad

More articles

-

White House denies report after 15 minutes of chaotic trading

-

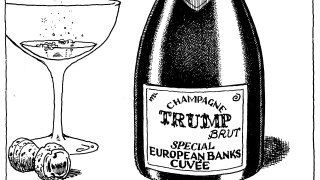

US stocks have been the big loser, while European banks could reap profits

-

-

Not clear whether guidance applies to other ABS

-

Universal bank in EMEA is still a work in progress, but Mizuho has chosen now to hire an M&A banker from BNP Paribas to lead the next stage of growth

-

McNamara retires, GAM looks for efficiencies in rebuild