LBBW

-

The Federal State of Schleswig-Holstein has mandated for a 20 year euro trade, as eurozone rates continue to squeeze tighter.

-

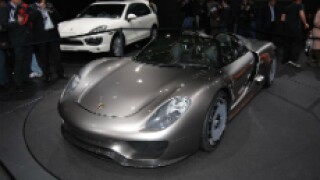

Porsche AG, maker of Porsche sports cars, closed a green Schuldschein this week, with pricing and allocation set for Friday. The final size is rumoured to be €1bn, with an order book far exceeding that.

-

Fraport, which operates Frankfurt airport and has stakes in several other airports, has entered the Schuldschein market for a second time this year, with an initial target of €200m.

-

-

The State of North Rhine Westphalia was flooded with demand for its 30 year euro benchmark this week as investors braced themselves for the European Central Bank’s meeting on Thursday, in which it laid down the groundwork for a rate cut in September and additional quantitative easing.

-

An infrequent FIG issuer returned to the medium term note (MTN) market this week to place the second of a pair of identical floating rate notes (FRN) this month. While on Wednesday, another bank brought back a structure that has rarely been seen since the financial crisis, according to one banker.

-

The State of North Rhine Westphalia was flooded with demand for its 30 year euro benchmark on Tuesday as investors braced for the European Central Bank's meeting on Thursday, in which it is expected to lay the groundwork for a rate cut in September.

-

German car parts maker ZF Friedrichshafen, which issued the largest ever Schuldschein in late 2015, is set to make a grand return to the market this year.

-

The State of North Rhine Westphalia mandated banks on Monday for a 30 year euro benchmark, ahead of a highly anticipated European Central Bank meeting later in the week, in which analysts expect the central bank to hint at a rate cut in September.

-

Financial institutions have nearly already raised as much green bond funding in 2019 as they did across the whole of last year, with LBBW’s funding chief suggesting that the market is still ‘growing on both sides’ as it is seeing more investor demand and issuer interest.

-

LBBW extended its non-preferred senior curve with a new green bond this week, hitting lead managers' price expectations in spite of soft market conditions.

-

A banker at LBBW has left its SSA origination and syndicate team to join its FIG debt syndicate, GlobalCapital understands.