LBBW

-

Austrian agency Asfinag won a big order book on Tuesday, allowing it to price 3bp tighter than guidance, in a 10 year tenor the issuer hasn't accessed since 2009. Municipality Finance and the German federal state of Lower Saxony will add to the euro SSA supply on Wednesday with a 10 year green bond and a seven year benchmark, respectively.

-

Lloyds Bank Corporate Markets, the non-ringfenced arm of Lloyds Banking Group, has made its capital markets debut. The UK bank went private to place short-end paper in both fixed and floating rate formats, ahead of a debut in the public market later this week.

-

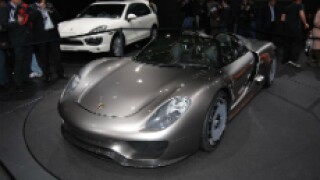

Porsche AG, maker of Porsche sports cars, has returned to the Schuldschein market, on the hunt for funds for research and development into electric cars, among other green projects.

-

The rally set off European Central Bank president Mario Draghi's assertion on Tuesday that further quantitative easing was possible, if not probable, had reached a level by Wednesday that astonished bankers. Three investment grade companies took advantage that day with benchmark bond issues, while one brought a tap.

-

India’s IndusInd Bank is paying up for its latest loan, after an aggressive price cut for its previous fundraising in 2018.

-

A structure developed in the loan market, in which a company’s financing margin can be lowered during the life of the deal if it improves its environmental, social and governance credentials, has crossed over into the Schuldschein market. That raises the possibility it could make the leap to the bond market, write Silas Brown and Jon Hay.

-

It's not often a €1.75bn deal from Volkswagen Leasing is overshadowed in the corporate bond market, though that was the case on Wednesday with Berkshire Hathaway's £1.75bn 20 and 40 year stormer. But Berkshire left euros clear for Volkswagen - it only had Bright Food of China to compete with.

-

Germany’s Deufol has signed a new five year syndicated facility, with the packaging company managing to cut the margin on its bank debt by around 25bp.

-

Schuldschein lenders are getting their first taste of environmental social governance (ESG) interest-linked notes next week, as Dürr takes its final orders on a transaction linked to its sustainability performance. According to several participants the trade has so far gone well, and will likely spark further Schuldschein borrowers using this new structure.

-

-

KfW returned to the market on Wednesday for its second five year euro benchmark of the year. The €5bn 0% July 2024 note was issued with the lowest yield the German agency has ever paid.

-

KfW returned to the market for its second five year euro benchmark of the year. The €5bn zero coupon note was issued with the lowest yield ever printed by the German issuer.