JP Morgan

-

The Emirate of Sharjah has mandated banks for a dollar Formosa bond. Some say the market is becoming an increasingly popular one for emerging market issuers to tap.

-

FMO may lower its 2020 funding target when it reviews its borrowing plan after the summer, which could lead to a postponement of a planned dollar benchmark to next year. The Dutch development bank made a strong return to the issuance of subordinated debt this week ahead of a call date in December of its previous deal in the format.

-

Chinese issuers continued to bombard the dollar bond market on Thursday. Hangzhou Financial Investment Group Co, Yankuang Group Co and ZhongAn Online P&C Insurance were among those that sold deals.

-

US corporate bond issuers got straight back to business after the July 4 weekend as 11 borrowers raised $10.8bn, though the volume of issuance is tapering off as companies head into earnings blackouts.

-

JP Morgan has extended its lead in European investment banking, scotching accusations of a retreat and dashing hopes of a change in the status quo, writes David Rothnie.

-

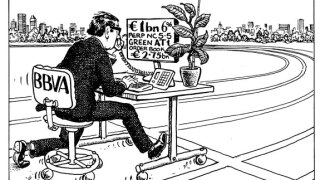

BBVA has become the first bank to print a green additional tier one (AT1) deal. When it was issued this week, it proved that the demand for socially responsible investments (SRI) extends to the riskiest of asset classes, meaning other banks are certain to bring out their own versions of the trade, writes David Freitas.

-

The dollar market has taken over from euros as the funding currency of the moment for SSA borrowers, with successful deals from IFC and and Japan Bank for International Cooperation.

-

Unédic came to the market for its third social bond on Thursday after making its debut in the format less than two months ago. The deal extends the French agency’s social curve out to 15 years and completes its €10bn explicitly guaranteed funding allowance for 2020.

-

Italy's AMCO Asset Management capitalised on strong investor demand to launch a dual tranche deal in senior format on Thursday, attracting a wide range of investors, according to one of the lead managers.

-

Immofinanz, the Austrian commercial real estate company, has raised €356m via the sale of new shares and mandatory convertible bonds to strengthen its balance sheet and take advantage of growth opportunities that the Covid-19 global pandemic has created.

-

France hit screens with a 15 year inflation-linked bond on Wednesday, raising €3bn with its first syndicated linker since 2018, capitalising on growing demand for inflation-linked products.

-

Central and Eastern European commercial real estate operator NEPI Rockcastle issued a green bond on Tuesday, attracting new investors to its debt.