Goldman Sachs

-

-

Hybrids and crossover rated corporate bond issuers hit screens this week, as the thirst for yield returned to the European market.

-

A trio of borrowers looked to slip in with conventional senior deals ahead of Wednesday’s US Federal Reserve meeting, with each paying a small premium to do so.

-

China’s Full Truck Alliance, an Uber-like service for trucks, launched an IPO on the New York Stock Exchange this week. It is aiming to raise up to $1.56bn.

-

The two riskiest issuers in Europe’s corporate bond market on Wednesday both opted for size over pushing hard on pricing. Poste Italiane with its hybrid capital issue and crossover-rated Finnish nuclear power company Teollisuuden Voima priced bigger than expected deals.

-

Unédic hit the market on Wednesday with a €2bn 15 year social benchmark, entering the market as the ripples from Tuesday's €20bn Next Generation EU bond print settled.

-

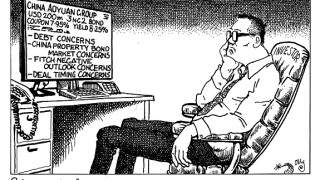

China Aoyuan Group’s attempt to woo investors to its $200m bond with a generous yield fell flat on Tuesday. Recent concerns about the property developer’s leverage, and the subsequent fall of its dollar bonds in the aftermarket, held investors back from the new deal — and caused a further spiral in secondary. Morgan Davis reports.

-

Aihuishou International, a marketplace for second-hand electronics, has kicked off a $243.5m IPO on the New York Stock Exchange.

-

-

-

Piraeus Bank showed the depth of investor demand for high-yielding bank debt this week when it brought the first additional tier one (AT1) out of Greece with one of lowest ratings ever seen in the market. Greek banks are now expected to turn their attention to the minimum requirements for own funds and eligible liabilities (MREL), where green labels and sustainability-linked structures could help them achieve their goals.

-