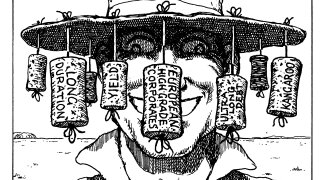

Issues

-

Lower than expected issuance volume to keep covered spreads tight into the autumn

-

There is no failure, only feedback; no stumbling blocks, only milestones

-

First batch of post-summer new issues flooded with demand, but will it last?

-

Industries familiar to Australian investors could find strong demand in Aussie dollar market

-

Diverse deals hit US market as investors look for yield pick-up across issuer types and formats

-

EDF proved that demand for ultra-long debt exists in Australian dollars but it won't last forever

-

International firms contend with rising swathe of locals set on hiring big name bankers as they tear into fee pool

-

Two years after acquiring Greenhill, Mizuho has bought another advisory boutique as part of its aim to become a top 10 force in global investment banking

-

◆ 'Tightest spread ever' in dollar SSA primary ◆ Flat or through fair value debated ◆ Technicals could push spreads even more

-

◆ Six year note from US automaker ◆ Order book lifts size to £400m ◆ Spread tightened 18bp inside the tight end of initial thoughts

-

◆ MetLife, Northwestern restart sterling issuance after two-month hiatus ◆ Corporates print as supply scarcity, redemptions create demand for credit ◆ Others beyond highly rated FABN unlikely to join

-

◆ Deal lands at record spread through OATs ◆ Immediate performance pushes OAT spread tighter ◆ Investors still keen despite tight price