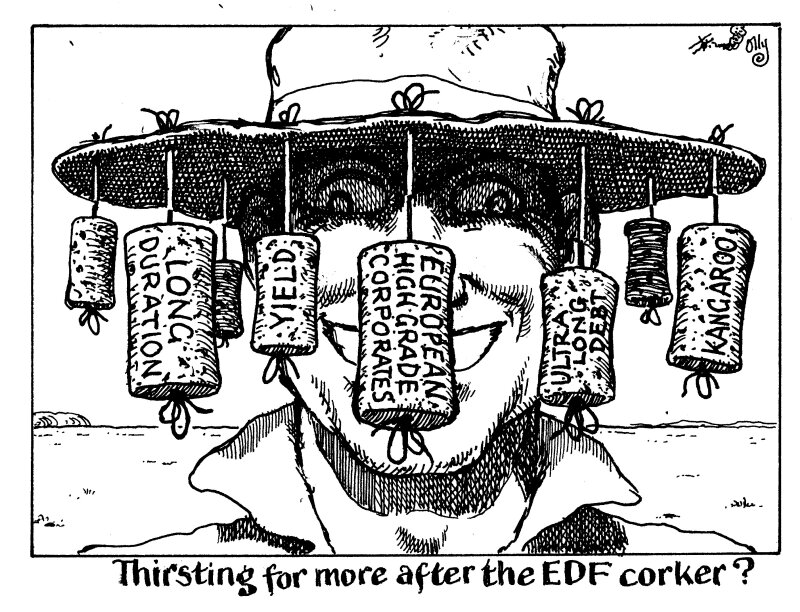

The Australian dollar market is having a moment among European high grade corporate borrowers. Plucky issuers that miss the insatiable demand for long maturities in euros a few years ago might consider a trip Down Under.

This week, France’s Electricité de France made its debut in the Kangaroo market with A$1bn (€553m) sold in equal portions across 10 and 20 year tranches.

Aussie dollar investors fell over themselves for the 20 year paper with final books of A$6bn, compared to A$4.4bn for the 10 year bond.

And herein lies the attraction for issuers and investors — one which European borrowers might recognise from recent history in their home market, before the European Central Bank cut it base rates by 175bp in a year to 2% and made buying ultra-long corporate debt far less attractive.

The Reserve Bank of Australia is just starting its rate cutting cycle, having made three 25bp cuts so far this year to bring its base rate down to 3.6%.

In a dynamic that played out in euros in 2023 and 2024, this means investors are keen to buy bonds with long duration to lock in yields before rates are slashed.

The eagerness for yield means investors are happy to overlook tight spreads, with EDF’s 20 year landing with a new issue premium of around 10bp, according to Nomura analysts. That was despite it being a debut and an ultra-long — two factors that typically mean higher concessions.

There are some factors that European borrowers should consider before booking the 24 hour flight to Sydney, however. EDF has essentially created the modern 20 year public corporate bond market in Australian dollars — the last 20 year was a sub-benchmark sized deal in 2021.

This means it is not a tried and tested pool of demand and perhaps EDF has hoovered most of it up.

The other factor is that it took EDF around two years to gladhand enough investors into participating in the order book, taking some from having zero knowledge of what the company is or does. It's no place for an opportunistic drive-by from a debutant.

But for those that already have a Kangaroo curve, it’s worth considering swapping bonjours for g’days.