Issues

-

◆ Why buy bonds when spreads are so tight ◆ Using tech to unearth new economic signals ◆ Playing the shifting relative value pitch

-

Private credit has carved a big role, but banks are hoping to get in

-

UK bank set to increase the pace in corporate and investment banking and create conditions for a smooth CEO succession

-

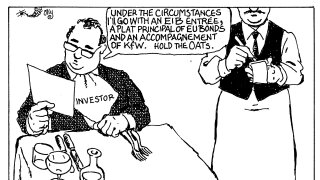

This year's two powerful trends of spread compression and convergence give rare issuers a chance to shine

-

European markets supervisor sets out priorities for coming year as SIU progresses

-

Macron's vision of a sovereign EU appeared closer in bond markets this week, thanks to French political discord

-

The next leg of the spread convergence between eurozone periphery and core FIG issuers could come from the east or south

-

Several public sector borrowers brought well received deals this week

-

Record tight sub/senior spreads could lure US corporates to issue euro hybrids

-

◆ Life insurance firm debuts ◆ Book peaks above €3.2bn ◆ Funding to refi bridge loan after consortium acquired the insurer earlier this year

-

-

German government spending programme drives interest in capital raising for acquisitions