Issues

-

◆ Sterling covered market on a 'hot streak' ◆ Strong demand pledged, including international interest ◆ Offshore sterling covered spreads compress

-

◆ Toyota drums up strong order book ◆ Spread tightens sharply from IPTs ◆ Size increased to €750m

-

-

-

◆ Holders win write-down ruling but path to recovery uncertain ◆ StrideUp brings Islamic innovation to UK securitization ◆ Emerging market bonds have an off-week (almost)

-

New dad faces tough reality of time management

-

Govvies outperform swaps as market participants contemplate next year’s spread direction

-

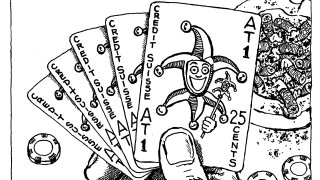

Credit Suisse AT1 bondholders should consider alternatives after this week's sharp repricing

-

The hire aims to strengthen the bank's middle market direct lending platform

-

Claims on Credit Suisse AT1 bonds shot up after a court ruling this week, though a long judicial process is anticipated

-

Primary markets in LatAm and CEEMEA had their quietest week since August

-

New parameters and guardrails help define oft-maligned product