Issues

-

Green format helps multilateral lender eschew new issue premium

-

South African bonds will do very well under some outcomes, but others pose a big risk

-

-

Be the change you want to see on the desk, but manage your expectations as to who will follow

-

Capital Markets Union: gauffre it ◆ The EMEA investment banking riddle ◆ Why EM bond investors keep buying deals that end up under water

-

Borrowers are using different strategies to optimise capital but strong market encourages the most subordinated deals

-

Investors keep showing up for deals that cheapen on the break

-

-

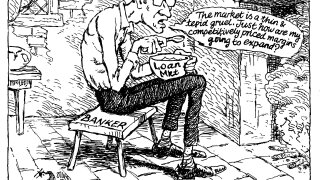

Japanese banks tighten lending, but wider impact remains uncertain

-

‘Rare occurrence’ where both issuers and investors are happy — but how long will it last?

-

◆ BPCE and Handelsbanken print first Yankee bonds of the year ◆ Citi increases perpetual size after $4.6bn book ◆ Flurry of activity from US insurers

-

An €8bn book for its debut hybrid puts company in strong position ahead of rights issue