Issues

-

The fund also added a green element to its revolver

-

◆ Both borrowers comfortably oversubscribed ◆ Deals tightened above the 37bp average ◆ Little fatigue seen after a bumper May

-

◆ EU’s securitization plan leaked ◆ The first new EM sovereign issuer for years ◆ Who can be sued for climate change?

-

Company plans to IPO from autumn 2027

-

US about to pass GENIUS Act as Trump associates promote stablecoin

-

Bank capital is a sentiment-driven product that is thriving in the present market mood

-

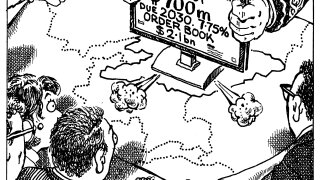

HSBC doubles down with first Yankee AT1 deals for three months

-

June could be very busy as borrowers come early to exploit good conditions

-

European banks progress with capital raising as spreads tighten, but investor qualms grow

-

Investors nervous about duration and fear steepening, but new opportunities could open up for issuers

-

Pricing was tight after sovereign found healthy demand

-

Issuers expected to squeeze in before tariff volatility returns and summer holidays start