Issues

-

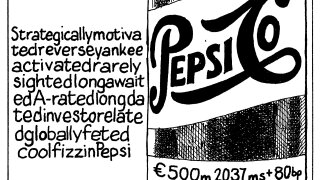

◆ Order book lifts size to €600m ◆ Deal lands flat to fair value ◆ US credits enjoy brisk summer sales in Europe

-

CEE has taken over as the region providing the majority of issuance

-

◆ EU budget ambition to cement issuer status ◆ French spreads ◆ Finally, the European bond market's consolidated tape

-

Better read on secondaries would help syndicates price bonds

-

Issuers pile in to market near multi-year tights

-

Looming regulation represents a stamp of legitimacy for BNPL lenders, which will lead them to public ABS issuance

-

Hundreds of billions of euros of joint debt needs to be agreed upon before 2028, but many questions unanswered

-

Budget induced volatility could push OATs above covered spreads across the curve

-

-

Lull in issuance imminent but searing hot market could entice more borrowers before party ends

-

-