By bringing the hitherto unregulated buy now, pay later (BNPL) sector under its remit, the Financial Conduct Authority has presented the sector with a much-needed opportunity for a rebrand — and could prove an unusual example of an increased amount of regulation smoothing the way to more public ABS issuance.

The FCA has thus far published a consultation, which closes on September 26, with a view to imposing rules in a year's time.

Proposals include making lenders do affordability checks on borrowers and forcing lenders to offer support to borrowers who get into financial difficulties.

These changes are expected to slow down the rate of BNPL transactions, lowering BNPL lenders’ profits by £1.2bn over 10 years, according to the FCA.

Many will argue that slowing BNPL loan origination pushes back the timeline for the first public ABS from the sector in the UK. However this view misses the upside of the rules.

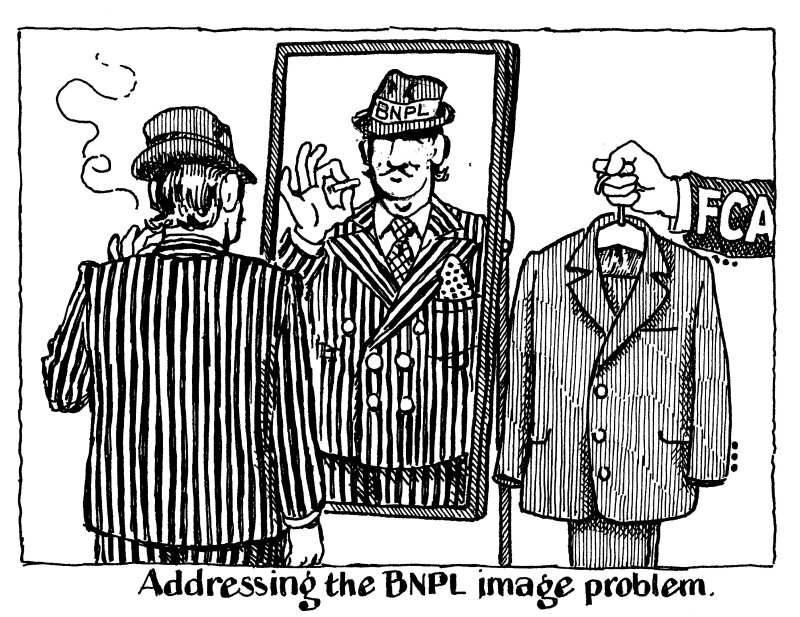

The BNPL sector has an image problem, with some arguing that its lending practices revive memories of before the 2008 financial crisis when cheap credit was given to poor quality borrowers such as by payday loan companies, like Wonga.

While these concerns can be exaggerated, they are not wholly unjustified, otherwise the proposed regulations would ultimately be redundant.

BNPL companies, such as Klarna, make small, short-dated loans to consumers to spread out the payment for products, often at the point of sale by smartphone.

Like the notorious payday loan companies of old, BNPL loans appeal to many consumers who are strapped for cash.

BNPL borrowers are more than twice as likely to be in financial difficulty compared to the average UK individual, so are more susceptible to the negative impacts of borrowing, the FCA states.

This regulation provides the sector with a stamp of legitimacy and adds a level of safety which has been reserved for more mainstream forms of lending, like credit cards and consumer loans.

Some BNPL companies, including Klarna, say they already adhere to higher standards of lending behaviour and welcome the regulations.

Even so, new rules will mean loans made to higher quality borrowers who will only use regulated financial services, and ease ABS investors’ concerns around the quality of the loans in a BNPL ABS, boosting demand for a nascent asset class.

While so much of the debate around securitization regulation is about removing red tape to unleash the industry's potential, this is one asset class where more rules rather than fewer will grow the market.