France

-

Investor focus elsewhere for now, but bankers warn that the medium term outlook is shaky after French election

-

The brokerage has hired a veteran equity capital markets banker as its head of market solutions

-

Airline attracted healthy oversubscription for its €2.25bn recap

-

The French bank has been involved in several top French mandates this year

-

Atos is embarking on a restructuring after a torrid 12 months

-

Combined company Forvia aims to be a leader in car batteries and electronics

-

Vallourec is enjoying a recovery after a difficult few years

-

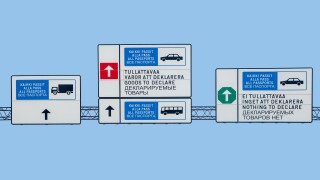

Russia neighbour cruises through busy sovereign market that also hosts France linker

-

Air France-KLM is raising €2.25bn to repay state aid

-

Insurer pair turn to sub debt to finance upcoming redemptions and tenders

-

LF sparkles as DZ and Crédit Ag flounder further out

-

As Paris basked in a heatwave for much of the last week, France's equity capital markets are also enjoying some time in the sun despite a terrible economic outlook for Europe