Finland

-

KommuneKredit is set to print a seven year euro deal on Wednesday, following a debut euro benchmark from Municipality Finance in the form of a €1bn October 2021 on Tuesday.

-

Nordea issued a notice on Friday seeking the consent of covered bond investors to agree to the terms of a deed poll and a new guarantee mechanism that will align its Finnish covered bond programme with its Danish, Norwegian and Swedish programmes. Moody’s says the proposal will not affect the credit rating.

-

KfW is set to print a 10 year euro benchmark, following in the footsteps of Belgium and Finland, this week as issuers attempt to conclude funding before the European Central Bank’s meeting on March 10.

-

The board of Sponda, the Finnish property investment firm, has decided to raise €220.8m in a rights issue to partially repay a bridge loan.

-

Two European sovereigns mandated for benchmark bonds in euros on Monday leading what is expected to be a scramble to get in and out of the primary market before the European Central Bank meeting on March 10.

-

Finnish property firm Sponda appointed just one lender to provide its €325m bridge loan, which will fund its acquisition of six prime properties in Helsinki.

-

Sanoma, the Finland headquartered media and publishing company, has retained support from its relationship banks in a €500m refinancing deal. But two banks did not return, as the group sought to slim down its syndicate.

-

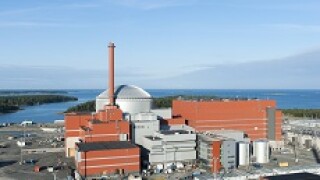

Teollisuuden Voima Oyj (TVO), the Finnish nuclear power company, has refinanced its €1.3bn debt facility with a reduced syndicate.

-

Private placements have taken up the bulk of Municipality Finance's funding so far in 2016, but the Finnish agency plans to make its debut public issue in euros this quarter.

-

Central Bank of Savings Banks Finland (CBSBF) pounced on the first sign of parting clouds in the global markets on Tuesday, dashing into the FIG market with a short dated floater.

-