Most recent/Bond comments/Ad

Most recent/Bond comments/Ad

Most recent

French banks lead the charge in euros with tighter than average NIPs

First public Spanish consumer ABS since September

Senior, capital issuance expected on Tuesday, after impact of historic precious metals sell-off is assessed

Domivest’s Dutch BTL trade has provided a benchmark for Citi

More articles/Ad

More articles/Ad

More articles

-

Warehouse backed by heating loans as well as solar

-

◆ Achmea's second RT1 this year ◆ Book continued to grow after tightening ◆ Investors 'looking for anything offering a bit of yield'

-

◆ Combined order books topped €9bn ◆ Demand continued to grow after tightening ◆ Tier two priced through fair value

-

'Wider issues' in sterling ABS market caused popular issuer's deal to land at IPTs

-

◆ Holders win write-down ruling but path to recovery uncertain ◆ StrideUp brings Islamic innovation to UK securitization ◆ Emerging market bonds have an off-week (almost)

-

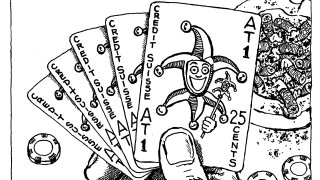

Credit Suisse AT1 bondholders should consider alternatives after this week's sharp repricing