Euro

-

Foreign investors show confidence in French assets, including innovative defence financing deal, as political concerns grow

-

German SSA issuers may adopt different strategies for upcoming deals

-

Corporates could trade through OATs as September 8 snap vote nears

-

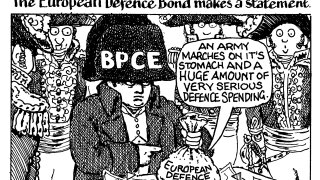

If you want peace, financially prepare for war

-

◆ Novel deal first of a kind from a non-SSA issuer ◆ Delivers 'political message' in readiness for defence financing ◆ Bankers debate whether issuer paid 'generous' concession

-

Headline risk ‘doesn’t tamper with the appetite for SSA products’ at the moment

-

◆ Deal is first since French PM called confidence vote ◆ Some concession left on top of wider secondary levels ◆ Bankers call French covered paper 'attractive'

-

◆ Spanish borrower brings another green print to euros ◆ Peak orders more than three times deal size ◆ Tight spreads persist for IG corporates

-

◆ French issuers pile into market ◆ Both borrowers push hard on spread ◆ Other French names expected before September 8 government vote

-

Markus Stix explains the sovereign's approach to recent euro syndication

-

Deals progressing as expected, despite a clear shift in neighbouring bond market

-

◆ Four years is the 'sweet spot' ◆ Existing curve ignored during pricing ◆ Slim premium paid over recent deals