Top Section/Ad

Top Section/Ad

Most recent

Mexico paid a similar new issue premium for its $9bn deal last week

◆ What has driven this week's record issuance and what might threaten sentiment ◆ Why the Maduro affair is a wake-up call for the EU ◆ Resolving Venezuela's debtberg

New issue premiums were slim for the LatAm sovereign duo

It will take years and huge amounts of money to get Venezuela in a state to restructure its debt

More articles/Ad

More articles/Ad

More articles

-

Market conditions are 'ultra supportive', said one banker

-

Two-part trade opens new investor base for the LatAm sovereign

-

Demand let A rated sovereign cut spread by 35bp

-

Investors hope a government more open to fiscal tightening will come to power in 2026

-

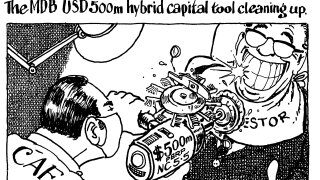

Bank intends to issue more hybrid capital but ‘more MDBs need to print’ for new asset class to grow further

-

The country has not printed a Eurobond for nearly five years