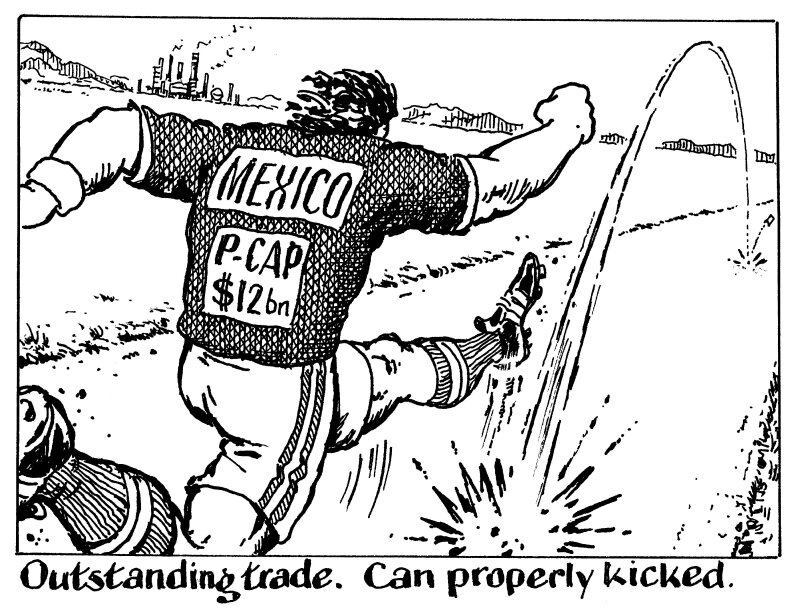

The bond market has, rightly, applauded Mexico’s complex 'pre-capitalisation' trade for Pemex, its tottering state oil company, on Monday. But the government should keep such innovation to a minimum and focus on solving the root cause of Pemex’s troubles.

Pemex, which would struggle to issue bonds in its own name because its debt is huge and its credit quality so bad, will receive $12bn to refinance near-term bank debt, at much cheaper rates than it could have obtained on its own.

What is impressive about the 'p-cap' is that everyone seems happy. Pemex gets cheaper money, investors buy Mexican sovereign debt more cheaply than usual and Mexico keeps the debt off its balance sheet, protecting its ratings. Even investors seem impressed.

But Mexico should not repeat the trick, for two reasons. If it keeps doing p-caps for Pemex, rating agencies will have to consider the off balance sheet debt when rating Mexico.

Downgrades are always bad but in Mexico’s case, they would be extra-painful, since it is close to the bottom of investment grade, at Baa2/BBB/BBB-.

More p-caps, or other innovations to hand Pemex money, would mask the real problem: a company in dire need of radical reform.

Oil production is very low, it is handing a big chunk of its cash flow to the government and it has a bloated workforce.

Mending this will not be easy, and it will take years. Politics will always rear its head, and no government relishes laying off thousands of state employees or reducing the amount of money it receives.

But a functioning Pemex would bring higher revenue, better profits and the ability to bring debt back to a manageable level.

That is what Pemex needs — tough medicine.

Continuing to play with p-caps or other funky formats would be making the mistake of treating the symptoms, not the illness.

Heal the real sources of Pemex’s financial woe and there will be no need for innovation. Then, Pemex will be able once again to look after itself in the international debt market, as it did for many years.