Most recent/Bond comments/Ad

Most recent/Bond comments/Ad

Most recent

Gulf investors 'will now look at every deal', whether sukuk or not

Demand from the Middle East for the sukuk was steady

Bond pricing for the mining company started about 43bp back of its parent

Sovereign wealth fund takes $2bn, as aimed at

More articles/Ad

More articles/Ad

More articles

-

The International Finance Corp (IFC) is planning just a $100m sized deal for its second ever sukuk transaction, according to a Standard & Poor’s rating report released on Wednesday.

-

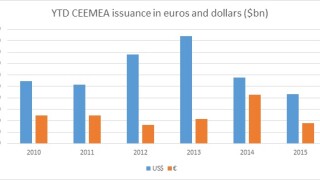

Year to date CEEMEA supply in dollars is a little over 40% of what it was in recent years, but the percentage decline in other currencies has been even worse, data from Dealogic shows.

-

An Emirati financial has mandated banks for a tier one dollar transaction, adding to the Middle East post-summer pipeline.

-

Malaysia’s Johor Corp (JCorp) has fixed the pricing of its Al-Salam Reit IPO at MR1 ($0.25) per unit, with bookbuilding scheduled to begin at the start of September.

-

The global sukuk market is heading for a correction in 2015, with total supply dropping between 40%-50%, according to Standard & Poor’s. But its claim of a stalling sukuk market overlooks thriving international benchmark issuance.

-

The global sukuk market is heading for a correction in 2015, with total supply dropping between 40%-50%, according to Standard & Poor’s. But their claim of a stalling sukuk market overlooks thriving international benchmark issuance.