Most recent/Bond comments/Ad

Most recent/Bond comments/Ad

Most recent

Gulf investors 'will now look at every deal', whether sukuk or not

Demand from the Middle East for the sukuk was steady

The deal has not been pulled or put on hold, said sources involved

Trump's verbal attacks on Nato allies and US rate volatility put issuance on ice

More articles/Ad

More articles/Ad

More articles

-

Plans by the EBRD to enter sub-Saharan Africa have been criticised by delegates at the annual meeting for taking on more responsibilities at a time when they have not completed their tasks in their original areas of operation

-

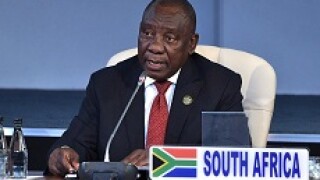

Analysts expect the African National Congress (ANC) to win South Africa's general elections next Wednesday. Although a number of deep-rooted domestic problems have the potential to throw the country into an economic crisis, bankers expect FIs to remain "safe" in the worst of scenarios.

-

EPP NV, a Polish firm that owns malls and office buildings, raised over €90m of equity capital in Johannesburg on Wednesday last week.

-

FirstRand Bank has transferred outstanding dollar debt from one of its syndicated loans to Rand Merchant Bank International. The amendment comes amid an anticipated increase in loan activity from South African banks, which bankers are keeping a close eye on.

-

Gold Fields Limited, a gold producer with operating mines in Australia, Ghana, Peru and South Africa, is embarking on a roadshow to market a five to 10 year dollar benchmark.

-

Santander creates new sales role — Barclays origination banker leaves — Algomi co-founder helps another fintech