EMEA

-

-

Consistency is vital as UK Debt Management Office insider takes reins from Robert Stheeman

-

Christian Noyer has proposed that the safe savings asset that European leaders crave should be a securitization platform. But scepticism that this is a realistic project runs high

-

◆ French bank pulled its €500m capital funding in early January amid crowded market ◆ New deal offers some call premium compared to the earlier bullet note ◆ Clears with up to 5bp-10bp new issue premium

-

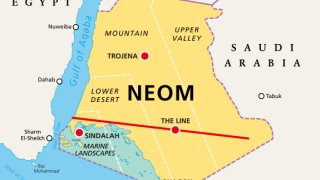

Only Saudi banks provide facility, as Western banks say the lack of ancillary opportunities makes the business case difficult

-

Borrowers at either end of ratings spectrum find success with green paper

-

A financing boom might succeed where stress has failed in easing corporate spreads

-

Sovereign to focus on preserving and injecting secondary liquidity next

-

Access to debt markets is increasingly relevant to CPI's ratings, said Moody's

-

Orders for the debutant's deal were building 'nicely'

-

Dubai supermarket group's IPO is multiple times covered, say sources

-

Evidence grows that companies can sell bonds successfully any day of the week