Top Section/Ad

Top Section/Ad

Most recent

The Americas derivatives community came together in New York to recognise and celebrate outstanding achievements across the industry

The derivatives market gathered in London on Thursday night to celebrate its leading players

Internal restrictions mean SSAs issue fewer CMS-linked notes

JP Morgan and Dutch pension fund PGGM transacted derivatives margin trade

More articles/Ad

More articles/Ad

More articles

-

The Australian Securities and Investments Commission has accepted an enforceable undertaking from BNP Paribas in relation to potential alleged misconduct involving the country’s benchmark, the Australian Bank Bill Swap Rate.

-

David Benayoun, a former event driven portfolio manager at HSBC in London, and Marc Ohayon, a former senior equity derivatives flow salesman at Barclays in London, are to launch a global event driven hedge fund.

-

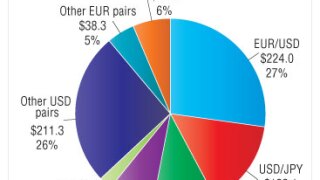

Average daily volume in over-the-counter fx instruments in the U.S. in October 2013 totaled USD816 billion, 19% down on April 2013, according to results of a survey released by the Foreign Exchange Committee of the Federal Reserve Bank of New York.

-

The Options Clearing Corp. is to launch S&P500 equity index option clearing in Q2, 2014 following regulatory approval to clear the instrument.

-

Hedge funds and real money players have been seen selling 10 year protection and buying 5 year protection on the iTraxx Main to play the flattening of the 5-10y curve.

-

With the Feb. 12 trade reporting deadline fast approaching, the race for European Markets Infrastructure Regulation compliance is now well and truly underway. EMIR is one of many new regulations governing derivatives trading across the globe and, like its North American counterpart Dodd-Frank, is the culmination of the post financial crisis movement towards increasing transparency and reducing risk within the market.