Top Section/Ad

Top Section/Ad

Most recent

The Americas derivatives community came together in New York to recognise and celebrate outstanding achievements across the industry

The derivatives market gathered in London on Thursday night to celebrate its leading players

Internal restrictions mean SSAs issue fewer CMS-linked notes

JP Morgan and Dutch pension fund PGGM transacted derivatives margin trade

More articles/Ad

More articles/Ad

More articles

-

UBS Securities was in plans to offer onshore total return swaps referencing Chinese A-shares, and separately offer equity-linked structured products via a special purpose vehicle structure, such as a trust or a mutual fund, on the back of a relaxation of propriety trading rules.

-

The ban on uncovered sovereign credit default swap trading in Europe could permanently impair E.U.-regulated sovereign CDS markets and cause further market stress when combined with European Central Bank tapering, bank failure and lack of liquidity.

-

R. Martin Chavez, chief information officer for Goldman Sachs in New York, will receive the Outstanding Contribution Award at the Americas Derivatives Awards on April 22. Chavez, who was selected for the award by senior buyside and sellside officials active in the derivatives markets, will be honoured for his contribution to the development of the derivatives market through his role at the International Swaps and Derivatives Association, as well as his success in developing Goldman’s Equities Franchise, among other areas. The full list of award categories and nominees can be accessed at www.derivativesweek.com.

-

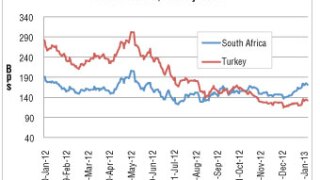

Emerging markets have a habit of triggering volatility compared to their developed market counterparties, as we have seen several times over the last 30 years. The trend was evident towards the end of January with fairly large swings in credit and equity.

-

Dealers of private EMTNs: Non-syndicated deals for <= €300m excluding financial repackaged SPVs, GSE issuers, self-led deals and issues with a term of < 365 days Dealers of private EMTNs including self-led: Non-syndicated deals for <= €300m excluding financial repackaged SPVs, GSE issuers and issues with a term of < 365 days Dealers of structured EMTNs including self-led: Structured, non-syndicated deals for <= €300m excluding financial repackaged SPVs, GSE issuers, puttable FRNs and issues with a term of < 365 days

-

Dealogic league tables of ECM transactions, last 12 months rolling.