Top Section/Ad

Top Section/Ad

Most recent

The Americas derivatives community came together in New York to recognise and celebrate outstanding achievements across the industry

The derivatives market gathered in London on Thursday night to celebrate its leading players

Internal restrictions mean SSAs issue fewer CMS-linked notes

JP Morgan and Dutch pension fund PGGM transacted derivatives margin trade

More articles/Ad

More articles/Ad

More articles

-

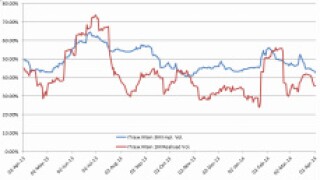

German asset managers are rolling credit default swaps on single names in the iTraxx Main into longer dated maturities to gain from the steepness of the curve.

-

ICAP has hired Wendy Phillis, ex-coo for Europe, Middle East and Africa at State Street, as group chief risk officer, based in London. She will replace Colin Smith, who is retiring from the industry.

-

The five year sector of the CNY swap curve picked up a bid on Thursday as foreign players placed bets on a corrective steepening in the 2s/5s curve slope. Credit Suisse expects the People's Bank of China (PBoC) to alleviate money market stress by delivering a 50bp cut in the reserve requirement ratio (RRR), writes Deirdre Yeung of Total Derivatives.

-

A mix of hedge funds and credit valuation adjustment desks are buying deep out-of-the-money payers with April expiries on the iTraxx Main and to a lesser extent the Crossover indices in what was a fairly active week in credit options. Flows skewed towards long volatility and hedging strategies.

-

The China Financial Futures Exchange plans to introduce a China volatility index and launch futures and options trading on it once the bourse completes the introduction of CSI 300 options later this year.

-

Blythe Masters, head of the global commodities group and CIB regulatory affairs at JPMorgan in New York, is to leave the firm after 27 years. Masters is widely regarded by market participants as one of the leading figures active in the development of the credit derivatives market in the 1990s.