Top Section/Ad

Top Section/Ad

Most recent

The Americas derivatives community came together in New York to recognise and celebrate outstanding achievements across the industry

The derivatives market gathered in London on Thursday night to celebrate its leading players

Internal restrictions mean SSAs issue fewer CMS-linked notes

JP Morgan and Dutch pension fund PGGM transacted derivatives margin trade

More articles/Ad

More articles/Ad

More articles

-

UBS has hired Jerry Kao, former director, equity derivatives trader at Deutsche Bank in New York.

-

Years ago, the motivational guru Tony Robbins came to visit my office, searching for the attributes of successful options trading. I was nervous about making a good impression. After all, he was the expert on success who wrote the book on getting the edge. What advice could I possibly offer? During the interview, it occurred to us both that the “secret sauce” of trading is similar to the required attributes of any profitable business. It must have a definable and consistent “edge”, it must be hard for others to harvest (even if the basic business concept is easy) and it requires relentless discipline.

-

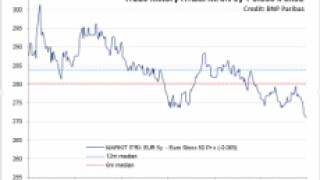

Hedge funds and fast money investors are going long the Eurostoxx 50 and shorting iTraxx Main despite a snap tighter on iTraxx indices and CDS after the European Central Bank announcement on Thursday.

-

The Montreal Exchange is planning to launch futures on the FTSE Emerging Markets Index, the first futures contract offering exposure to that particular underlying.

-

A stronger than expected Chinese trade report has backed an improvement in risk sentiment and paying across the CNY swap curve. Short-end long positions have been trimmed ahead of price data on Tuesday but the 1s/10s curve has steepened on the long-end sell-off, writes Deirdre Yeung of Total Derivatives.

-

Credit investors will remember the summer of 2012 as the turning point of the eurozone sovereign crisis. Mario Draghi’s “whatever it takes” intervention caused a decisive shift in sentiment and triggered a long rally that has lasted to this day.