Top Section/Ad

Top Section/Ad

Most recent

The Americas derivatives community came together in New York to recognise and celebrate outstanding achievements across the industry

The derivatives market gathered in London on Thursday night to celebrate its leading players

Internal restrictions mean SSAs issue fewer CMS-linked notes

JP Morgan and Dutch pension fund PGGM transacted derivatives margin trade

More articles/Ad

More articles/Ad

More articles

-

2015 set a number of records in the options market as traders flocked to index and volatility-linked products, but equity options volumes dipped due to factors that look likely to persist in 2016.

-

Get bought or go bust: Is this the year when vulnerable oil & gas companies have to make the choice? So far this year, derivatives traders are pricing contracts for more vulnerability to come.

-

ISDA’s Determinations Committee has decided to hold a second day of discussions on Novo Banco, after failing to reach agreement on Wednesday over whether the Portuguese bank has triggered a government intervention credit event or a succession event.

-

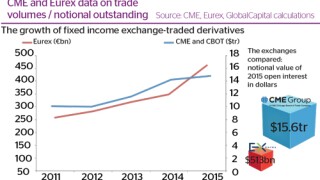

Competition between derivatives exchanges is intensifying, giving rise to a rash of product and platform launches in 2015, as well as geographical expansion. But 2016 will be dominated by regulatory deadlines for electronic trading. As Dan Alderson reports, exchanges that best prepare market participants to meet these requirements will be the ones that will win out.

-

2015 will be remembered as a year when volatility returned to financial markets. With strong technical buffers to the trading range of US and European equity markets going into 2016, short volatility strategies look set to be compelling money earners in the year ahead, writes Andrew Barber.

-

ISDA’s Determinations Committee will meet at 12pm London time on Wednesday to decide whether Portugal’s Novo Banco has triggered a government intervention credit event, but will also deliberate a succession event in relation to the transfer of senior bonds to Banco Espirito Santo.