Top Section/Ad

Top Section/Ad

Most recent

The Americas derivatives community came together in New York to recognise and celebrate outstanding achievements across the industry

The derivatives market gathered in London on Thursday night to celebrate its leading players

Internal restrictions mean SSAs issue fewer CMS-linked notes

JP Morgan and Dutch pension fund PGGM transacted derivatives margin trade

More articles/Ad

More articles/Ad

More articles

-

The upending of global financial markets in the second half of 2016, driven by shocks from the UK’s Brexit vote and US presidential election, has caused a breakdown in previously dominant cross-asset correlations and a sharp resizing of event risk in 2017. Dan Alderson reports on a wave of structured product innovation aimed at navigating this new and more volatile universe.

-

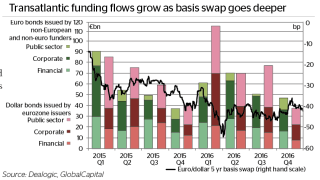

Cross-currency swap markets face a rough start to 2017. Traders fear that diverging central bank policy, a shift in corporate borrowing dynamics and a repatriation of US money will all upset the basis at different parts of the curve. Dan Alderson reports.

-

The European Securities and Markets Authority wants more convergence between central counterparties on how they comply with margin and collateral requirements.

-

China and Russia are forging ahead with closer financial market ties, with the Moscow Exchange (Moex) and Shanghai Stock Exchange (SSE) looking to facilitate two-way investments between the countries. This comes as the Russian ministry of finance is still finalising plans for the first RMB-denominated bond to be issued in Russia.

-

The US Commodity Futures Trading Commission has given Goldman Sachs a $120m penalty for trying to manipulate dollar Isdafix and falsely reporting benchmark swap rates.

-

Eurex, the derivatives exchange of Deutsche Börse, has hired Lee Bartholomew and Zubin Ramdarshan to work on research and development for new derivatives products.