Top Section/Ad

Top Section/Ad

Most recent

The Americas derivatives community came together in New York to recognise and celebrate outstanding achievements across the industry

The derivatives market gathered in London on Thursday night to celebrate its leading players

Internal restrictions mean SSAs issue fewer CMS-linked notes

JP Morgan and Dutch pension fund PGGM transacted derivatives margin trade

More articles/Ad

More articles/Ad

More articles

-

With yields compressed and equity volatility at a historically low level, hunting for consistent returns has been a challenge for asset managers and institutional investors alike. But as Costas Mourselas reports, the meteoric rise of risk premia strategy, a type of passive investing, promises to at least partially alleviate those woes.

-

Five years after being pushed on to trading venues in the US by the Dodd-Frank Act, over-the-counter derivatives players are beating a similar path in Europe, under the Markets in Financial Instruments Directive II. Most people think MiFID II has been a worse experience, and will make it harder for small players. But efficiency gains may follow. Ross Lancaster reports.

-

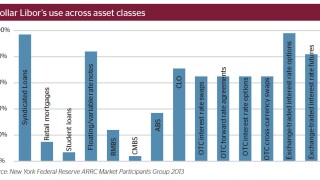

It is six months since Andrew Bailey, head of the UK financial regulator, set the clock ticking on a transition from the London interbank offered rate to an alternative. But if credible replacements are to be ready by his 2021 deadline, there is still a mountain of work to do. Ross Lancaster explores the risks of phasing out the old benchmark and asks if it could yet survive.

-

UniCredit has hired a senior Crédit Agricole banker as head of markets sales.

-

The London Stock Exchange this week reaffirmed its commitment to open access under the second Markets in Financial Instruments Directive, as major European exchanges and clearing houses (CCPs) were granted exemptions from the requirement until July 3 2020.

-

LCH Group and pan-European exchange Euronext have revealed their completion of a share swap, in which the exchange took a 2.3% stake in LCH Group in return for an 11.1% stake in France-based clearing house LCH SA.