Top Section/Ad

Top Section/Ad

Most recent

The Americas derivatives community came together in New York to recognise and celebrate outstanding achievements across the industry

The derivatives market gathered in London on Thursday night to celebrate its leading players

Internal restrictions mean SSAs issue fewer CMS-linked notes

JP Morgan and Dutch pension fund PGGM transacted derivatives margin trade

More articles/Ad

More articles/Ad

More articles

-

FX settlement firm CLS has gone live with a new service that will standardise and automate the calculation of payment netting on bilateral FX trades.

-

Trade body the Futures Industry Association (FIA) on Tuesday released recommendations on how to shore up clearing house (CCP) risk management processes in the wake of a €114m member default at Nasdaq Clearing in September.

-

The International Swaps and Derivatives Association on Tuesday said the derivatives industry seemed to have broadly agreed on a method of calculating replacement rates, known as fallback rates, for interbank offered rates (Ibors), in case those rates stop being calculated.

-

LCH, the London-based clearing house, has pumped up its compression offering, reducing members’ notional outstanding by $4.5bn through its FX clearing arm, ForexClear.

-

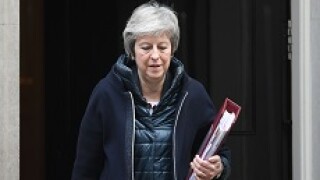

As UK prime minister Theresa May looks to sell her Brexit deal to a disgruntled parliament, banks have been suggesting different options structures to clients to net positive returns from the resulting turbulence.

-

The European Securities and Markets Authority (ESMA) on Friday said that its board of supervisors supported “continued access” to UK clearing houses in a no-deal scenario.