Top section

Top section

Most recent

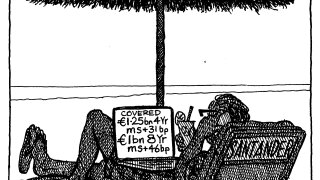

◆ Both legs of dual tranche tightened ◆ Only one covered has landed tighter this year ◆ Banker said both tranches were at fair value

Newfoundland prints 20 year, Crédit Agricole debuts a green covered bond

Market tipped to be a marathon, not a sprint, as Aareal Bank becomes fourth issuer of 2026 and fixed rate tranches take root

Data

Sub-sections

Sub-sections

Deal reviews

◆ Spread tightened by 5bp ◆ Banker put fair value just inside 58bp ◆ Canadian banks continue strong start to year in covereds

◆ BayernLB lands covered at 23bp over mid-swaps ◆ Banker says deal landed at fair value ◆ PBB achieves 'blow-out deal'

◆ Covered was first from issuer since October 2025 ◆ Spread chosen to retain quality of order book ◆ Pipeline update

◆ Issuer had market to itself on Tuesday ◆ Deal landed covered just outside fair value ◆ Issuer's first covered bond since October

Opinion

Rate increases could be closer than you think

Equalising risk weightings of covered bonds and resilient STS securitizations at 5% is sound

Bank's head of DCM and syndicate chief talk bond market expansion plans

◆ Why buy bonds when spreads are so tight ◆ Using tech to unearth new economic signals ◆ Playing the shifting relative value pitch

Analysis

Specialist investors and strong names dominate as issuers stretch out to 15 years

Unsecured bonds could become more expensive to issue, covered bonds cheaper

The euro covered bond market shook off a volatile end to 2024 to rebound with a raft of exceptionally popular deals in 2025. Investors appeared eager to pile into euro covered bond books this year, propelling bid-to-cover ratios upwards and new issue premium downwards, writes Frank Jackman

Covered bond funders will have to weave their way through tight senior unsecured and wide SSA spreads in 2026 if they are to refinance the wave of redemptions that awaits them. One big question for the year ahead, discovers Frank Jackman, is whether issuers will be tempted to pay up for duration

More articles

More articles

More from covered bonds

-

Santander's popular dual tranche deal could spur others to follow, but flood of trades is unlikely

-

◆ Deal attracts more than €10bn ◆ Rarity of name and jurisdiction fuels demand ◆ No premium needed to take size

-

Increased residential lending demand could help support issuance