Top Section/Ad

Top Section/Ad

Most recent

The US tech giant kickstarted what could be a deluge of debt issuance from the largest US tech firms

◆ Junior note lands tight to Class As ◆ No concession needed ◆ Lack of sterling supply allows for tight pricing

◆ Peak book the largest for an IG corporate in sterling since early November ◆ Issuer takes size at a tight spread ◆ Wide range of fair values spotted

◆ Spanish entity hits market with tight, opportunistic trade ◆ Some attrition as deal priced through inflection point ◆ Trade lands through fair value

More articles/Ad

More articles/Ad

More articles

-

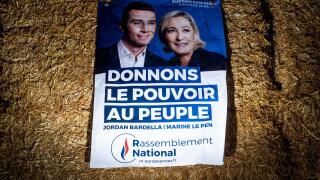

Issuers both land big books as market quickly shrugs off French election volatility

-

Silfin also lines up a deal as French politics opens primary market wide

-

Hung parliament seen as best outcome for bond issuers, even if swing to left was unexpected

-

Spread pressure will rise as earnings return to growth for the first time in five quarters

-

Market expected to shut after Wednesday as UK elections and US holiday loom

-

As supply becomes scarcer, it will be easier for companies to sell dirty debt as green