Top Section/Ad

Top Section/Ad

Most recent

The US tech giant kickstarted what could be a deluge of debt issuance from the largest US tech firms

◆ Junior note lands tight to Class As ◆ No concession needed ◆ Lack of sterling supply allows for tight pricing

◆ Peak book the largest for an IG corporate in sterling since early November ◆ Issuer takes size at a tight spread ◆ Wide range of fair values spotted

◆ Spanish entity hits market with tight, opportunistic trade ◆ Some attrition as deal priced through inflection point ◆ Trade lands through fair value

More articles/Ad

More articles/Ad

More articles

-

◆ Scottish utility prints eight year green bond ◆ Order book peaks at more than three times covered ◆ Small new issue premium paid

-

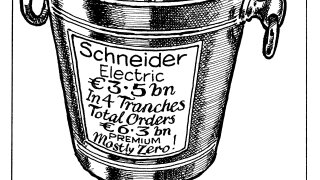

◆ French issuer prints two year floater and four, 6.5 and 12 year bonds ◆ Peak demand tops €11bn across the four tranches ◆ 12 year bond attracts the largest final book

-

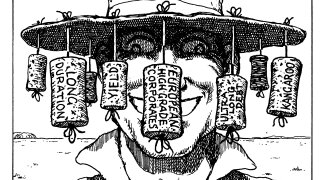

◆ Asia Pacific pair tick investor boxes ◆ Solid demand despite tight spreads ◆ Premiums vanish in euros

-

Volume for 2025's reopening week is billions down on 2024

-

Industries familiar to Australian investors could find strong demand in Aussie dollar market

-

EDF proved that demand for ultra-long debt exists in Australian dollars but it won't last forever