Top Section/Ad

Top Section/Ad

Most recent

The US tech giant kickstarted what could be a deluge of debt issuance from the largest US tech firms

◆ Junior note lands tight to Class As ◆ No concession needed ◆ Lack of sterling supply allows for tight pricing

◆ Peak book the largest for an IG corporate in sterling since early November ◆ Issuer takes size at a tight spread ◆ Wide range of fair values spotted

◆ Spanish entity hits market with tight, opportunistic trade ◆ Some attrition as deal priced through inflection point ◆ Trade lands through fair value

More articles/Ad

More articles/Ad

More articles

-

Duration, ESG structure and rating help the company secure more than five times subscribed book

-

US issuer lands 'outstanding' deal, prompts hopes it could spur Reverse Yankee issuance

-

Embattled company’s long dated spreads resilient despite new defensive plan and S&P downgrade

-

Europe’s IG corporate bond market is in danger of finding out how many straws it takes to break a camel’s back

-

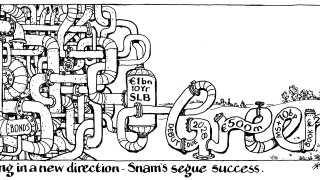

Italian gas group wins big book for debut green tranche

-

Even the highest rated corporate borrowers are able to bring spreads in by leaps during bookbuilding in scorching market