CEE Bonds

-

-

Hopes rise that EM primary bond market is coming back to life

-

South Africa brings long awaited dollar offering as Croatia mandates banks

-

Cetin tightened pricing by 15bp in its second ever foreign currency bond

-

Russia sovereign heads towards default

-

The approach to sanctions gave the Russian government the opportunity to present itself as a debtor that will keep on paying against the odds

-

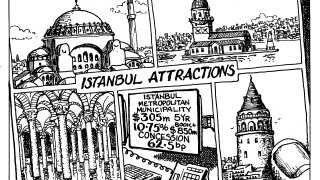

The municipality is the first Turkish non-sovereign issuer since mid-January

-

Russia had been meeting Eurobond obligations but its latest payments have not gone through

-

Investors said Russia's move was smart, and non-sovereign issuers may follow its lead

-

Emerging market appetite to return as Swiss risk sentiment shifts

-

Pledge to avoid coal spending brings new technique to Europe

-

Size of coupon too small to trigger cross-default