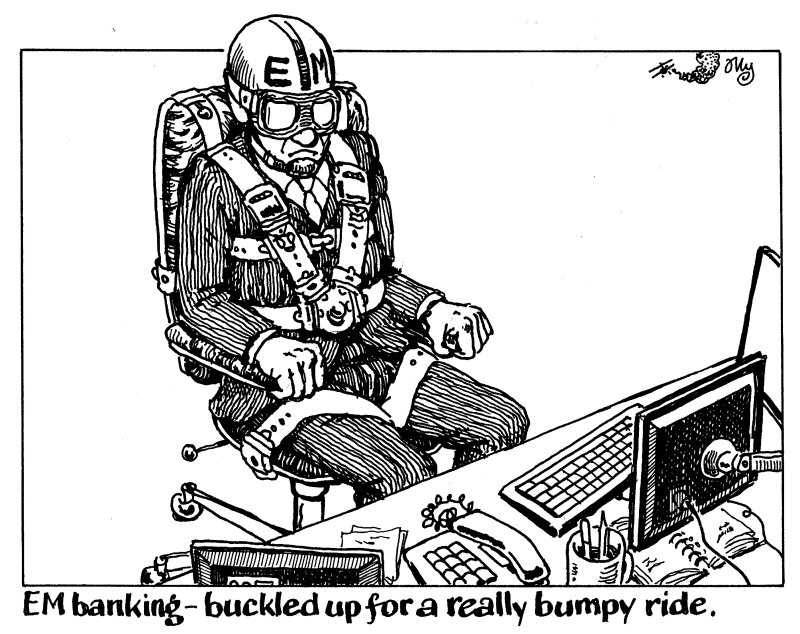

These are tough times for all those involved in EM primary bond markets. New issue volumes have taken an unprecedented drop, and some are wondering if things will ever be the same again.

EM bond issuance so far in 2022 stands at just $192bn — down from $330bn this time last year, according to data from Dealogic. In CEEMEA, volumes are 46% lower year-on-year, while Latin America is trailing last year’s run rate by 47%.

Some on the sell side admit to being worried about the future of the market, and suggest DCM houses will have to adjust to the “new normal” of lower volumes.

Sure, a portion of the doom and gloom is justified. The transformation of the EM bond market since the 2008-2009 financial crisis was underpinned by an extended era of historically low rates and quantitative easing. This era is over, and developed world inflation is now back, so certain borrowers who had suddenly found international bonds were an attractive option may now look elsewhere for their funding.

As the market continues to reprice, the riskiest credits could find that market access — at a cost that makes economic sense — has simply gone for good.

What’s more, countries that have been key parts of the (post-financial crisis) market could also be mostly leaving the EM bond community. Russia can be struck off the list of potential sources of supply for many a year. if not decades, while the Middle Eastern sovereigns that inflated CEEMEA volumes in recent years could discard bonds once again.

Yet most EM borrowers that have shied away from the bond market this year have pretty mundane reasons. It’s important to remember that the past two years — with Covid-19 leading to a lucrative combination of very low rates with very high government funding needs — were the exception, not the norm.

Sovereign borrowers, thanks to the winding down of Covid-related fiscal stimulus, have lower dollar funding needs. This includes issuers that had tapped bond markets in unprecedented volume in 2020 and 2021, such as Chile and Peru.

Meanwhile, the idyllic conditions that ran almost uninterrupted between mid-2020 and September 2021 encouraged most experienced EM issuers to accelerate funding plans. They knew that trickier times were looming and got ahead of the game, so liability management needs have been quite low in 2022. These borrowers will be back in the coming years.

Though some very risky credits may not regain market access, for most high yield companies this year is simply about readjusting price expectations and waiting for lower execution risk. Even if the market eventually settles at a level that means higher costs of funding for everyone, it will eventually settle, making pricing bonds a smoother process.

It is not new, either, for EM bond markets to lose entire countries as sources of new issue business. Volumes from Argentina fell to virtually nothing in 2018, and LatAm DCM desks simply adapted. There was, after all, plenty of restructuring to be done in the country.

Ultimately, in good times or bad times, EM countries and companies will still need money. The expertise and increased sophistication gained on both issuer and investor side during the decade-long EM bond market boom hasn’t gone anywhere and means there will be always be new candidates looking for bond market cash.

If recent market turmoil is a sign of a global recession, you can be sure corporate issuers will be looking to shore up cash and most EM governments will have higher funding needs. If the economic recovery continues, then all the better for emerging markets, which still have a long way to catch up with developed nations and will need financing to do this.

Brace for a tough remainder of 2022, but don’t underestimate EM’s resilience.