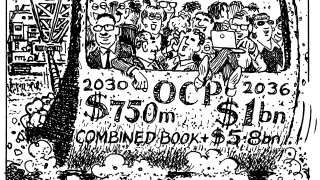

Cartoon

-

US covered bonds could fill the triple-A rated void left by the sovereign's downgrade

-

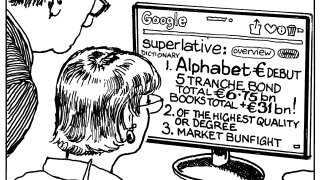

◆ Japanese bank returns to euro market after many years ◆ Global asset managers reducing US dollar exposure ◆ Euro issuers facing increased competition

-

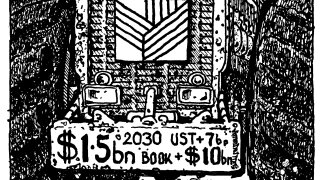

◆ Biggest book for Rentenbank in any currency, according to lead ◆ Agency raises $1.5bn ◆ Sets stage for more dollar issuance

-

◆ QTC aims to build curve in euros ◆ Monitoring dollars too ◆ Canadian comps used

-

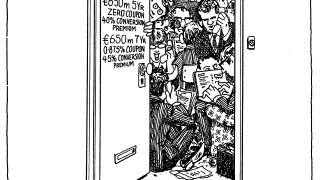

Convertible market is hot, say bankers

-

Investment banks wishing to cut costs with AI should remember what clients pay for

-

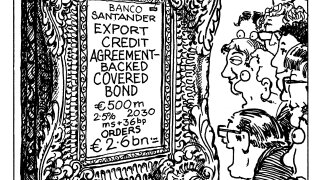

◆ Bond secured against a pool of export credit agreements ◆ Santander gets biggest bid-to-cover ratio since March ◆ Deal lands flat, if not through, fair value

-

Both companies will benefit from a gold price one banker called 'amazing'

-

◆ $9bn raised in one go, peers inspired ◆ ‘Very efficient’ dual-tranche serves issuer well ◆ Tight Treasury spread but 'where the market trades’ is important

-

Fiserv and Visa print across the curve with more tipped to come

-

Borrowers establish new levels for pricing regulatory capital issuance

-

A wide spectrum of borrowers eyeing primary market after weeks of pause