Moody’s cut the US’s credit rating by one notch to Aa1 last Friday, meaning the world's largest economy and supposedly it's least risky asset is now judged to be as creditworthy as cosmetics firm L'Oreal.

Are US Treasuries worth it? Time will tell.

Regardless, for the first time since the big three credit rating agencies began rating the sovereign, it no longer holds a single triple-A rating.

Unsurprisingly, this is not great news for investors with mandates for triple-A rated US risk.

Of course, there are still alternatives available: many US states and municipalities still hold triple-A ratings, as do plenty of asset backed securities and bonds issued by Johnson & Johnson and Microsoft.

But these are not top-drawer alternatives available in the same size as the US’s previously triple-A rated paper.

US sub-sovereign borrowers still have some exposure to the sovereign. Meanwhile, ABS is a complex product to understand, favoured by specialist investors who are rewarded with triple digit spreads for the risk. And of course, corporates are not regular, programmatic funders.

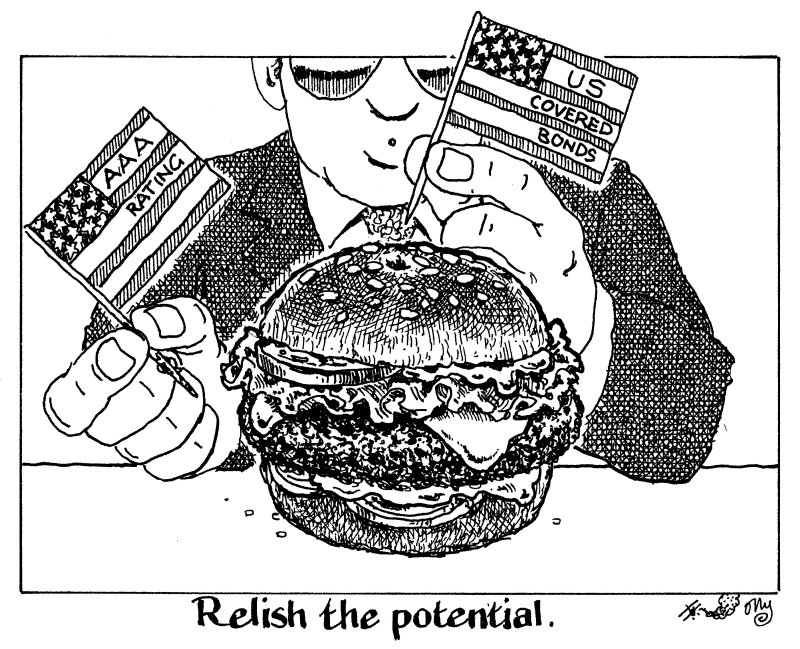

However, a rekindling of the US mortgage-backed covered bond market could go a long way towards filling part of the gap.

Like soccer, covered bonds never really took off to the same extent in the US compared to Europe. Sure, there was a brief period of mild interest many years ago — back when the US still held more than one triple-A rating — but no US bank has issued a covered bond since 2007, according to Dealogic.

In Europe, covered bonds are a popular proxy for sovereign risk — and in many cases hold ratings many notches higher. The sheer size of the European mortgage market means there is a regular supply of the paper for investors to feast on, with issuance placed across the curve, depending on lending needs.

Arguably, mortgage-backed covered bonds offer investors direct exposure to the real economy of a country via its housing market — albeit with the added benefits of a dual recourse structure and a near zero default rate.

At the end of 2023, there were over €3.2tr-equivalent of covered bonds outstanding worldwide, according to ECBC data. And although this is a mere 10% of the US treasury market, covered bonds are considered liquid and safe enough to be used by bank treasuries for various regulatory purposes.

The US mortgage market is vast, totalling some $12.8tr at the end of the first quarter, according to data from the New York Federal Reserve — that is one big cover pool.

And although it is unlikely US banks would divert from their current funding avenues, even funding a smidgen of this via a covered bond would flush the market with much needed triple-A liquidity.

When Bank of America sold the sole dollar covered bond in June 2007, it printed $2bn on a single tranche. As the saying goes, everything is bigger in the US — including their covered bonds, and their potential to issue many, many more. Now all the market needs is a law.