Investment bank leaders are hoping for dramatic efficiency gains from implementing artificial intelligence.

David Solomon, CEO of Goldman Sachs and occasional DJ, made headlines earlier this year when he said 95% of the work of drafting an IPO prospectus can be done by an AI in minutes.

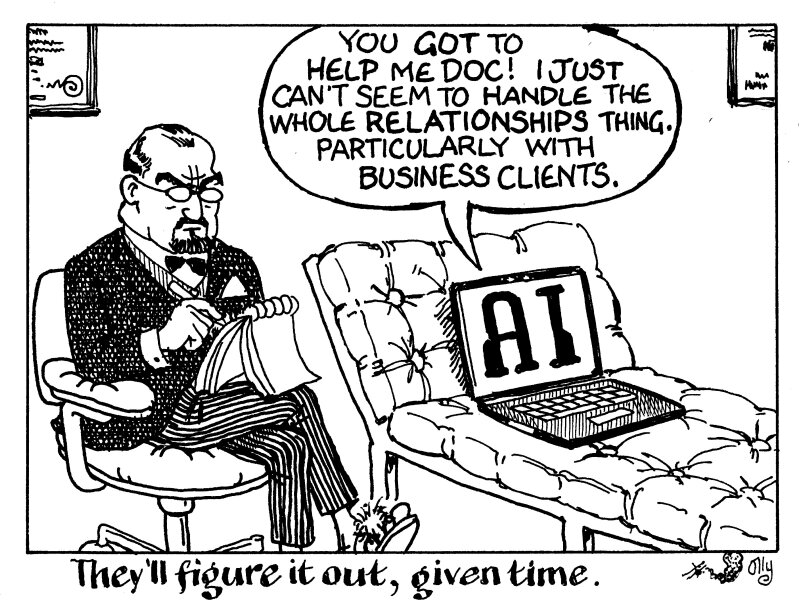

While efficiency gains in some areas of investment banking are welcome and happening already, AI has little to contribute to the core activities where investment bankers justify their generous fees: strong interpersonal relationships across the markets and spotless advice.

AI makes producing large amounts of text cheap and fast. The boilerplate IPO prospectus, or a perfectly aligned PowerPoint deck, can indeed be produced much faster and nearly as well by a well-trained model than an analyst in training.

But this content production is only a very small part of what clients expect.

The marrow of banking remains trust: above all, what clients buy is the ability to sleep soundly as their bankers manage the complexities of their financial affairs.

Receptiveness to client needs and constant availability at key junctures are necessary reassurances which build this trust, as is a reputation for sound execution.

AI in its current form can do nothing to bolster a client relationship. No chatbot can replace a familiar voice at the end of the line.

If anything, mistakes from hallucinations and opaque models could lead clients to doubt an AI-dependent banker’s competence and dedication to their cause.

So while AI has a role to play, until investment banking - perhaps belatedly - becomes more science than art, it is in the chorus rather than as a lead part.