Cartoon

-

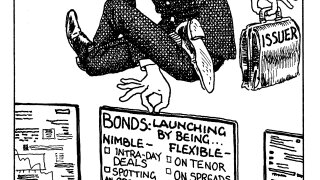

Issuers, bookrunners and investors are finding savvy ways to navigate the market turbulence, including changing how they approach deals

-

Two year covered bond funding is not ideal, but may become the best option

-

This is not the time for complacency in corporate bonds

-

Syndication market’s resilience can enable banks to demand higher pricing

-

Banker hails “bond beyond oil” but some green investors shun it

-

Forget tax cuts and bonus caps — ministers were told how to boost the City last year

-

Market is growing bullish about southeast Asia’s IPO market, with pipeline building slowly but steadily

-

It's hard to see the newly installed politicians in the UK backing down so soon in the job. So far they have been utterly deaf to criticism. Instead, it is likely the Bank will have to give away further ground. Bad for the Bank, and ultimately bad for the UK economy

-

The new code of conduct for ECM and DCM deals hasn’t quite had the desired impact

-

Even defensive deal credentials fail to help Swedish white goods maker tighten spread

-

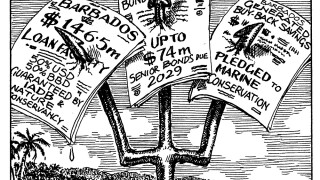

Bankers see Barbados’s debt for nature swap as the most efficient of its kind

-

Kwasi Kwarteng's plan to scrap the banker bonus cap is a good idea but his timing is awful