The UK government has messed up so badly with policies lately — in particular, tax cuts for high earners and scrapping the bankers’ bonus cap — that even those who were set to benefit the most were calling for them not to be imposed.

If Lizz Truss’s government really wants the City of London to boom, it should follow policy recommendations made over 18 months ago and make it easier for London-listed companies to raise equity capital.

Events during the last fortnight have caused deep dismay in UK capital markets. Unexpected borrowing to fund both tax cuts and support for energy bills provoked brutal sell-offs in sterling and Gilts.

The government did reverse one of its policies — scrapping the top rate of income tax — but urgent action is needed to stop the UK from becoming an equity market backwater.

The volume of new IPOs in London slumped this year to its lowest level since 2009, amid a global downturn.

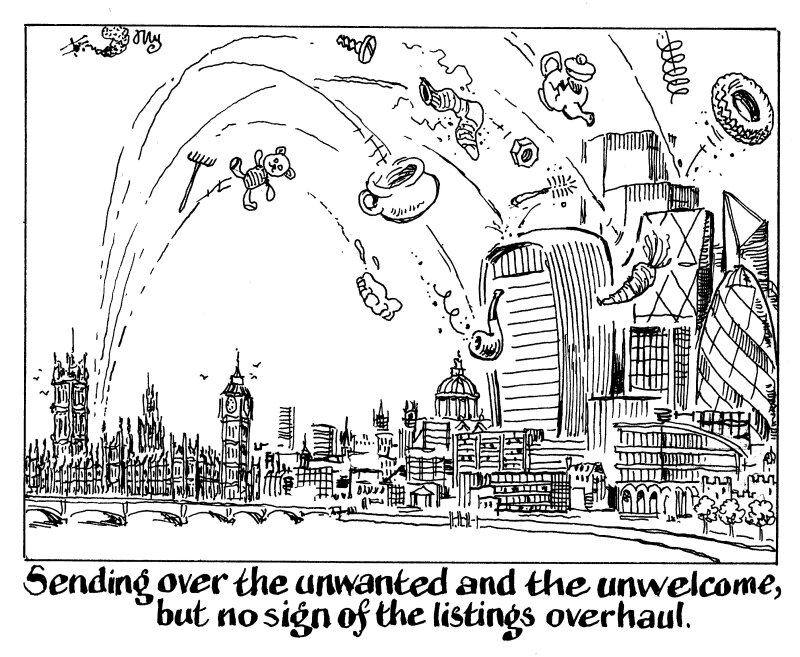

Prized issuers are shunning London as a listing venue too. CVC is said to prefer Amsterdam, while SoftBank could be relisting Arm — the celebrated British chip firm — in New York, despite intense lobbying by the UK government.

Few in the equity capital markets were crying out for the bonus cap to go or for the highest earners to get tax cuts.

Instead, they want the government to make good on a promise to overhaul London’s listing rules and make it easier for companies to raise capital.

Decent progress has already been made as a result of the UK Listing Review published in March 2021. And the Secondary Capital Raising Review, delivered in July, contains further juice for the government to squeeze.

There is enthusiasm in the market for the proposals in these reviews. The government would do better to implement them, instead of dabbling in fiscal iconoclasm, if, as prime minister Liz Truss said on Wednesday, it truly wants “growth, growth and growth”.