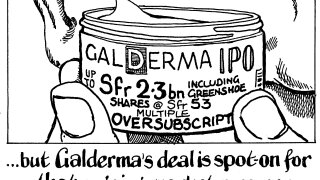

Cartoon

-

The final size of the base deal will be Sfr2bn after the IPO was priced at the top of the range

-

European financial institutions should not neglect investors wanting supply in the belly of the curve

-

More credence should be placed on recent deals as secondary curves trade wide of new issues

-

Investors expect issuance to keep flowing as the Fed cuts rates and inflows return

-

Issuers should take cue from the EIB's persistent chipping away at its funding need

-

◆ Dutch insurer refinances legacy tier one at negative NIP ◆ More insurance deals expected across capital structure ◆ Smaller European bank tier twos prove strength of FIG market

-

Wind company spins order book more than five times deal size

-

Why lock in a high spread just because primary conditions are stellar?

-

Tight spreads are drawing issuers and investors to lock in high yields while they can

-

Bankers hopeful more supply will follow, but no pipeline forthcoming

-

Investors are hungry for higher yielding FIG bonds

-

Up to two visits to primary market planned each year, but senior unsecured is not on the bank's radar